For companies, opportunity costs do not show up in the financial statements but are useful in planning by management. The three basic cost behavior patterns are known as variable, fixed, and mixed. Variable costs are those that will vary depending on the output of the store. In a retail setting, these costs might include sales commissions, inventory purchased for resale, cash register tape and packaging materials such as bags.

Step 2 of 3

Regardless of whether he produces and sells any T-shirts, he is obligated under his lease to pay $1,000 per month. However, he can consider this fixed cost on a per-unit basis, as shown in Figure 6.25. Economies of scale refer to a scenario where a company makes more profit per unit as it produces more units.

Step 1 of 3

Units produced, units sold, direct labor hours and machine hours are all possible activity bases or cost drivers in a manufacturing facility. Using units sold as a cost driver, you wouldn’t need to buy raw materials for 1,000 widgets if you only have orders for 500. These costs include direct materials, direct labor and some of the manufacturing overhead items. Another important characteristic of discretionary costs is their variability. Unlike committed fixed costs, discretionary costs are directly influenced by changes in production or sales volume.

- However, for every night that a room is rented, Ocean Breeze must remit an additional tax amount of $5.00 per room per night.

- A variable cost1 describes a cost that varies in total with changes in volume of activity.

- Note that the Ocean Breeze mixed cost graph starts at an initial $2,000 for the fixed component and then increases by $5 for each night their rooms are occupied.

- To increase production beyond a certain level, additional machinery must be deployed.

- By managing committed costs effectively, companies can ensure financial stability and operational efficiency, even in times of uncertainty.

- It is important to note that manufacturing overhead does not include any of the selling or administrative functions of a business.

Correlation between expense and output levels

For these companies, direct labor in these industries is becoming less significant. For an example, you can research the current production process for the automobile industry. As you’ve learned, direct materials are the raw materials and component parts that are directly economically traceable to a unit of production. Step costs are best explained in the context of a business experiencing increases in activity beyond the relevant range. Remember that the reason that organizations take the time and effort to classify costs as either fixed or variable is to be able to control costs. When they classify costs properly, managers can use cost data to make decisions and plan for the future of the business.

In managerial accounting, different companies use the term cost in different ways depending on how they will use the cost information. The term mixed cost5 describes a cost that has a mix of fixed and variable costs. For example, assume sales personnel at Bikes Unlimited are paid a total of $10,000 in monthly salary plus a commission of $7 for every bike sold. This is a mixed cost because it has a fixed component of $10,000 per month and a variable component of $7 per unit.

Submit Your Info Below and Someone Will Get Back to You Shortly.

It employs around \(200,000\) people, and it’s indirectly responsible for more than a million jobs through its suppliers, contractors, regulators, and others. Its main assembly line in Everett, WA, is housed in the largest building in the world, a colossal facility that covers nearly a half-trillion cubic feet. The Boeing Company generates around $90 billion each year from selling thousands of airplanes to commercial and military customers around the world. It employs around 200,000 people, and it’s indirectly responsible for more than a million jobs through its suppliers, contractors, regulators, and others. Take your learning and productivity to the next level with our Premium Templates.

Some examples of variable costs include fuel, raw materials, and some labor costs. On the other hand, the factory’s wage costs are variable as it will need to hire more workers if the production increases. Fixed costs are a type of expense or cost that remains unchanged with an increase or decrease in the volume of goods or services sold.

The article “committed vs discretionary fixed costs” looks at meaning of and difference between these two types of fixed costs. A financial concept that measures the proportion of fixed costs in a company’s cost structure, affecting repaying the first its profitability as sales change. In the electronic parts example, it was illustrated how such costs can vary based on quantities ordered. Perhaps one might order and store large quantities of the part for use in future periods.

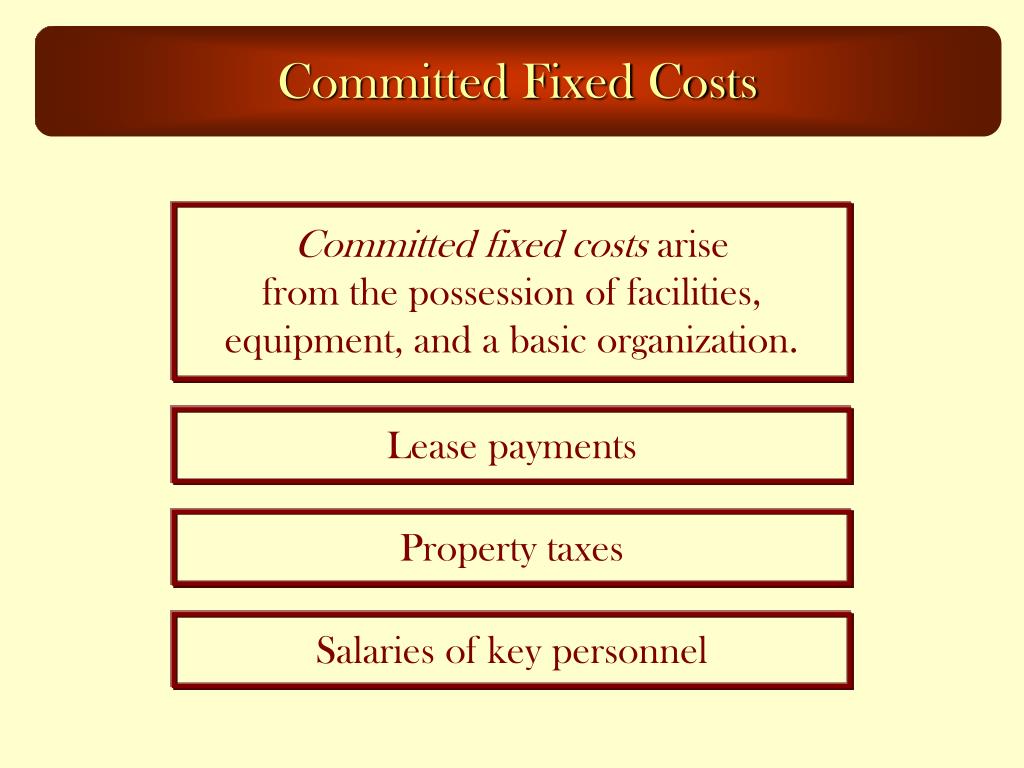

Committed Costs are expenses that a company has already agreed to pay in the future due to previous commitments or contracts. These costs are usually fixed and cannot be easily adjusted or eliminated without incurring penalties or breaking agreements. Committed costs often include long-term expenses such as leases, salaries, and loan repayments. While preparing budgets and undertaking costing for its products, these costs must be included at their committed values as they cannot be avoided or eliminated.

All of our content is based on objective analysis, and the opinions are our own. The monthly data in Table 2.4 “Monthly Production Costs for Bikes Unlimited” includes Total Production Costs and Units Produced. Thus use one column (column A) to enter Total Production Costs data and another column (column B) to enter Units Produced data. Looking at this analysis, it is clear that, if there is an activity that you think that you cannot afford, it can become less expensive if you are creative in your cost-sharing techniques. Watch the video from Khan Academy that uses the scenario of computer programming to teach fixed, variable, and marginal cost to learn more.